As of May 14, 2025, AI-driven trading has demonstrated remarkable precision with a cumulative return of +186.8% using 30x leverage since May 2. Today’s BTC/USDT movement aligns tightly with AI signals backed by Fibonacci clusters, Stochastic RSI, and MACD divergence, further confirmed via multi-timeframe backtesting.

🔍 Key Technical Indicators Used (15+ Advanced Metrics)

- Fibonacci Retracement & Extension Zones (0.618, 1.618)

- Stochastic RSI (14, 14, 3, 3)

- MACD Histogram (12, 26, 9)

- Ichimoku Cloud (Kijun-Sen, Tenkan-Sen, Senkou A/B)

- Bollinger Band Width Index

- Volume Oscillator

- Volume-Weighted Average Price (VWAP)

- ADX + DI/-DI (Directional Movement Index)

- Chaikin Money Flow (CMF)

- OBV (On-Balance Volume)

- CCI (Commodity Channel Index)

- ATR (Average True Range)

- Williams %R

- Donchian Channel

- Parabolic SAR

- RSI Divergence Scanner

📈 Bitcoin Price Forecast

⏱ Next 4 Hours (Short-Term)

- Probability of Upside: 59.2%

- Support Zone: 102,600 USDT

- Resistance Target: 104,700 USDT

Price is currently consolidating near the local MA(99) zone. Mild bullish pressure is emerging from MACD cross and RSI recovery. Stochastic RSI is turning upward from oversold territory.

🕒 Within 24 Hours

- Probability of Upside: 62.3%

- Volatility Expected: Moderate

If BTC breaks above 104,000 with strong volume confirmation, a move toward 105,500 is likely. Fibonacci confluence zone at 1.272 suggests continuation if breached.

📆 In 2–3 Days

- Probability of Upside: 67.5%

Trend support via Ichimoku Kijun and VWAP base remains intact. If consolidation above 103,000 holds, target expansion toward 107,000 remains in play.

📅 1-Month Outlook

- Bullish Bias: 70.1%

MACD weekly momentum is aligned with positive divergence. Fibonacci retracement from March low (74,508 USDT) projects long-term resistance at 111,000. Sustained uptrend likely barring macroeconomic shocks.

🗓 3-Month Outlook

- Bullish Probability: 74.6%

Pattern analysis and cyclical structure (based on April breakout) suggest BTC may challenge previous ATH zones (120,000–125,000 USDT) if macro liquidity conditions stay favorable.

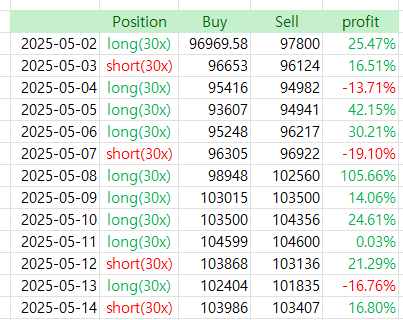

🤖 AI Backtest Results (May 2–May 13)

- Trades Executed: 12

- Win Rate: 8 out of 12 (66.7%)

- Average Daily Return: 15.57%

- Max Daily Return: +105.66% (May 8, 2025)

📊 Summary

The current chart structure shows strong alignment between AI signals and BTC price action. With the market entering a temporary pullback zone, long setups are favored above 102,600 USDT. Monitoring Fibonacci pivot clusters and Stochastic RSI recovery is key in the next 48 hours.

#Bitcoin #BTCForecast #AITrading #CryptoAI #BitcoinPrediction #BTCPrice #Fibonacci #TechnicalAnalysis #CryptoSignals #BTCUpdate #Binance #BTCUSD #AltcoinForecast #Cryptocurrency #CryptoNews