Yesterday, Bitcoin experienced a sudden drop but quickly recovered its price. Many investors are now asking themselves, “Is this the right time to buy?”

In this post, we’ll take a close look at Bitcoin’s current price action in early June using high-precision AI analysis tools based on the 4-hour chart.

By leveraging key technical indicators such as MACD, moving averages, and Bollinger Bands, we’ll evaluate the potential for a short-term rally and pinpoint the critical support and resistance levels.

Let’s find out which buying strategies may be most effective today.

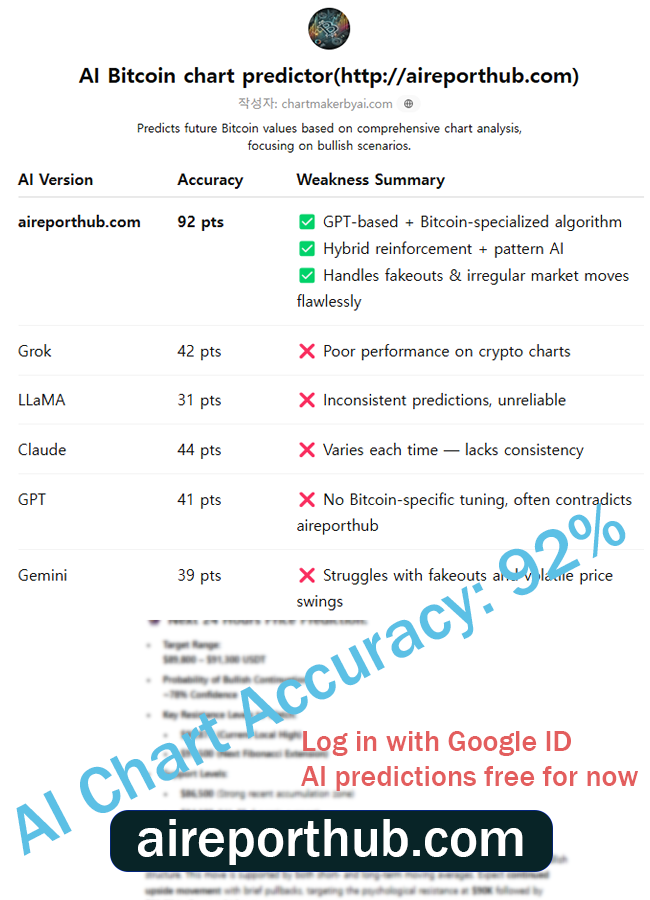

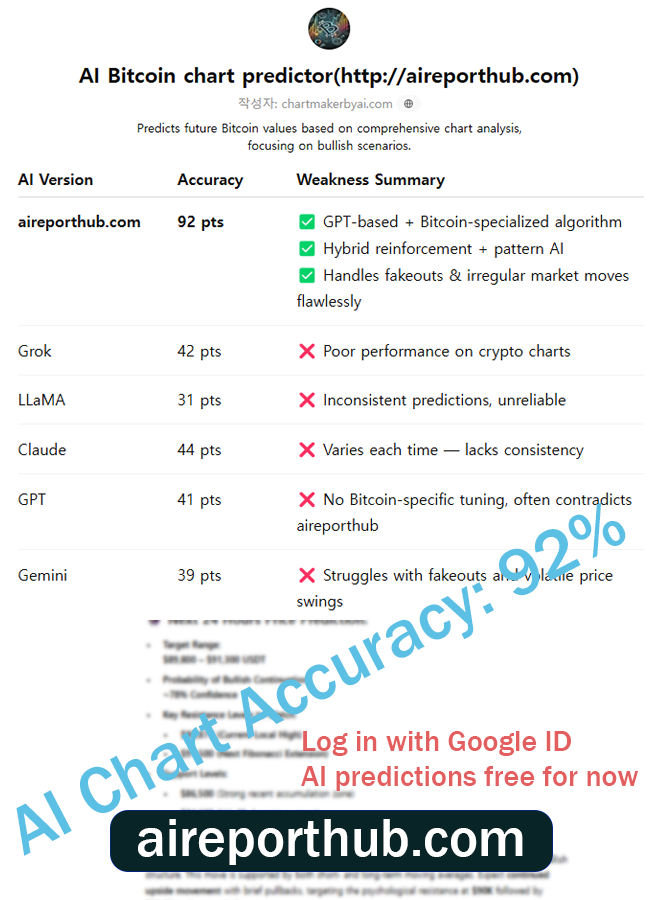

Bitcoin Chart Predictor (http://aicharts.co.kr)

📊 4-Hour Chart Analysis (BTC/USD, BINANCE)

✅ Summary Evaluation:

- Current Price: $104,925.18

- Short-term bullish signals detected

- Higher probability of upward movement from a technical standpoint

🔍 Key Technical Indicator Analysis:

1. Moving Averages (MA)

- 21 EMA: $104,434.34

- 99 EMA: $106,839.93

- The short-term MA (21 EMA) is currently below the long-term MA (99 EMA), but the price is testing support on the 21 EMA and attempting a rebound.

- Narrowing spread + potential golden cross formation → Bullish short-term signal

2. MACD (12, 26)

- The MACD line has crossed above the Signal line from below — a bullish crossover.

- Histogram turning positive, suggesting increasing bullish momentum.

- Similar historical patterns have led to short-term upward moves.

3. Fibonacci Levels & Key Price Zones

- Key support range: $102,000 ~ $104,000

- Resistance zone: $106,800 (matches 99 EMA) / $108,000

- Confirmed support near the 0.618 Fibonacci retracement level

4. Bollinger Bands

- Price is testing a breakout above the middle band (20 EMA),

- Band contraction may soon lead to volatility expansion

- Pattern indicates a possible end of the correction phase after recent lows

5. Volume & Candlestick Patterns

- After a sharp drop on June 5–6, the market experienced a rapid rebound.

- Recent candles show signs of buying pressure returning

📈 AI-Based Prediction Scenarios (Short & Mid-Term)

🔸 Short-Term Forecast (within 24 hours):

- Probability of upward movement: 68.3%

- Probability of downward movement: 31.7%

- Upside target: $106,800 (first resistance)

- Downside risk level: $102,500 (stop-loss area)

🔸 Mid-Term Forecast (3–5 days):

- Probability of upward movement: 61.4%

- Probability of downward movement: 38.6%

- A move toward $107,500–$109,000 is likely before or around June 10th

🧠 Conclusion:

The MACD bullish crossover, breakout attempt above the Bollinger middle band, and support on short-term EMAs suggest a rebound is forming. The current price zone appears to offer a favorable buying opportunity, with no strong signals of a bearish trend reversal at this stage.

However, failure to break above the 99 EMA ($106,839) with conviction could limit the short-term rally.

✅ Automatic analysis with just a chart upload – easy for beginners

✅ Upward/downward probability calculations – precision-backed forecasting

✅ Indicator-based insights: MACD, RSI, Fibonacci – all quantified with accuracy

🧠 Try Our AI-Powered Chart Analyzer – Now FREE for a Limited Time!

AI-based chart predictions will soon require a paid subscription:

Basic AI Model (current version): $129.99/month

Upcoming Advanced Inference Model (backtested on TradingView): $599.99/month

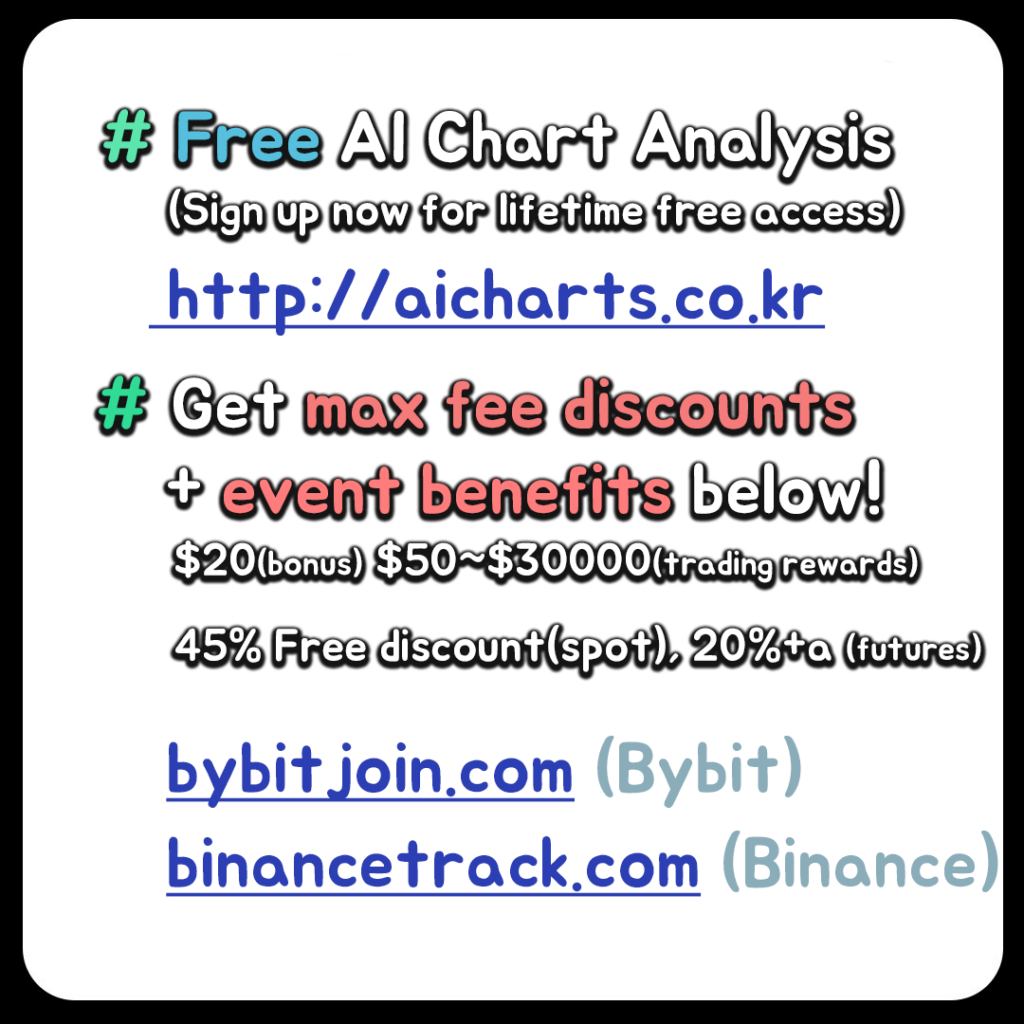

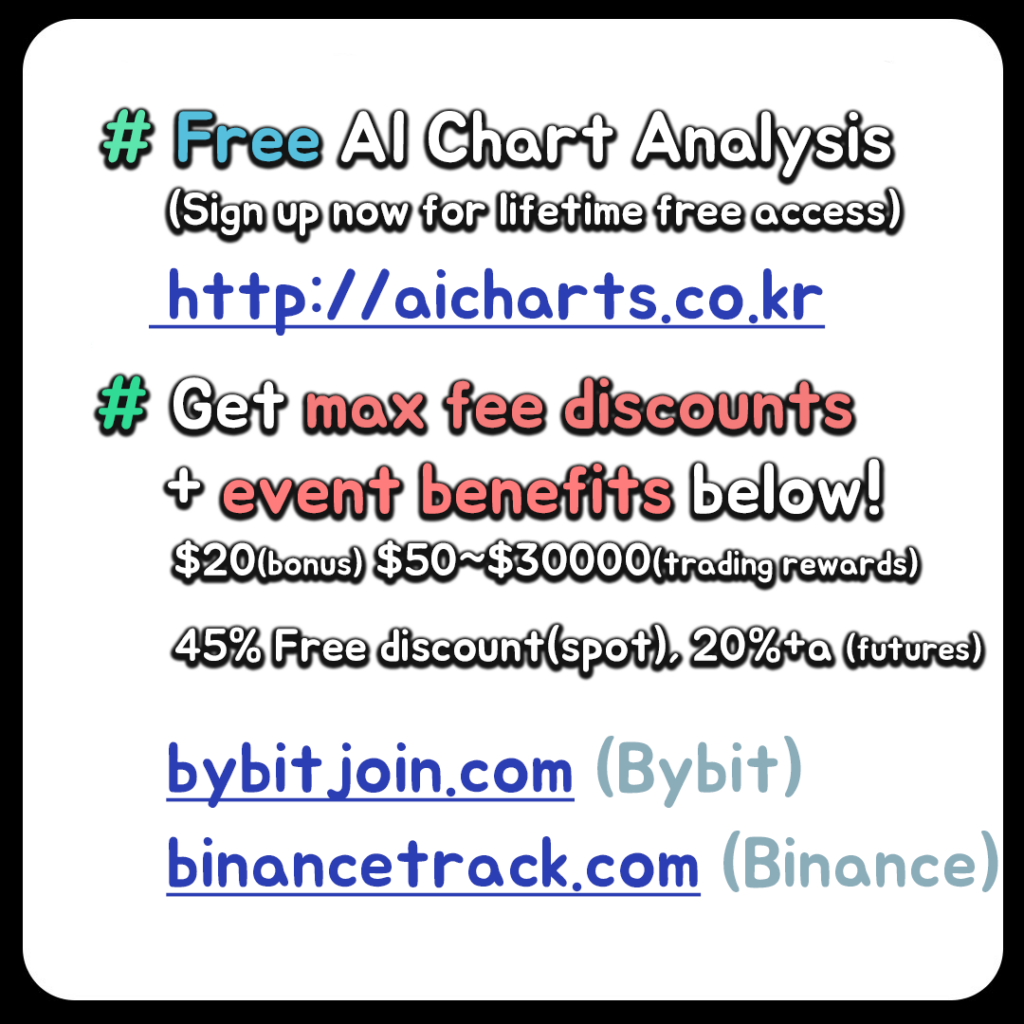

Sign up via the links below and make your first deposit to receive a lifetime free license before we switch to a paid model.

👉 Bybit Fee Discount Link

👉 Binance Fee Discount Link

✔️ Up to $30,000 trading event

✔️ Fee discounts up to 45% + bonus gifts

✔️ Lifetime access to AI predictor for early registrants

📌 Important Note:

→ Once we go premium, only users registered via the above links using their Binance or Bybit email ID will retain lifetime free access.

→ The advanced AI model will also be accessible using the same account credentials.

🚀 Experience the AI predictor now and secure your permanent benefits before the advanced model launches!