The weekend is over, and June is almost over too.

I don’t usually post on my blog or upload YouTube videos during the weekend.

Creating YouTube content requires recording, and blogging needs to be done on a computer — but I trade exclusively on mobile during weekends.

Trading itself is very convenient on mobile, but writing blog posts or producing YouTube content is quite difficult to do from a phone.

Actually, I’m saying this because I have a bit of a personal routine on weekends. It’s still private for now, but I’ve found a strategy that tends to generate reliable profits over the weekend.

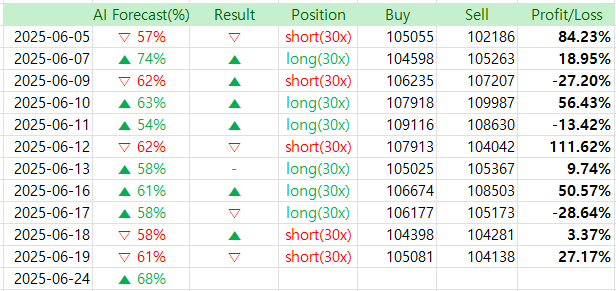

This past weekend was especially successful. The AI predictions were all correct, and the price moved exactly in line with expected patterns, both up and down — resulting in significant profits.

The public performance shows a 600% return for June so far, but if I include this weekend’s private trades, the total return would likely exceed 1200%.

Let’s start today with another round of forecasts.

Over the weekend, the chart movement was pretty simple, right? Price bounced off the 99-day moving average, dipped, then reversed upward after hitting a Fibonacci support line.

It seems the Israel-Iran ceasefire also played a role.

Usually, price doesn’t change this sharply just from news events, but there were some sudden moves on the chart that likely reflect that influence.

Now, I’ll post the updated AI forecast — let’s dive in.

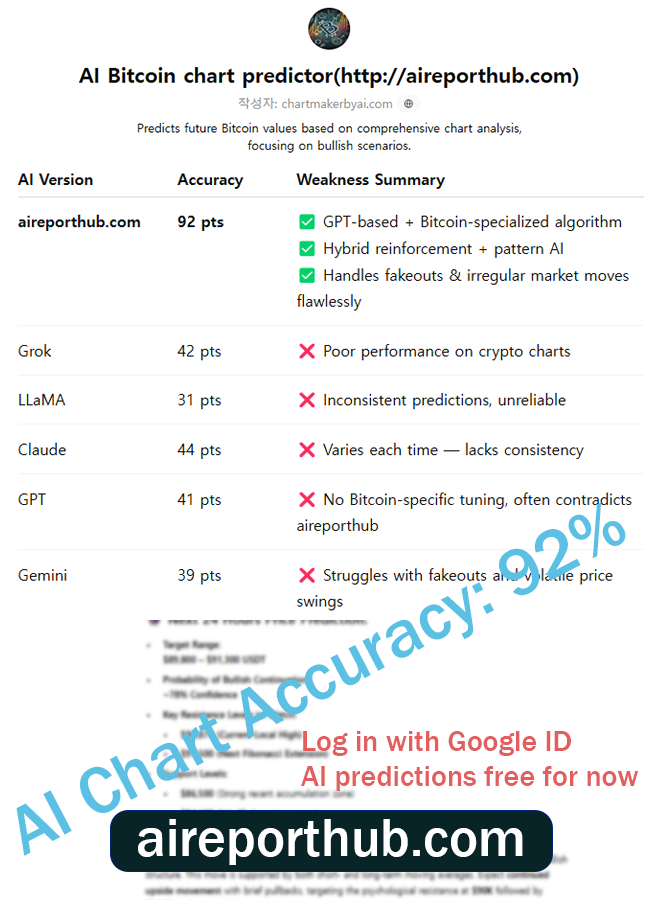

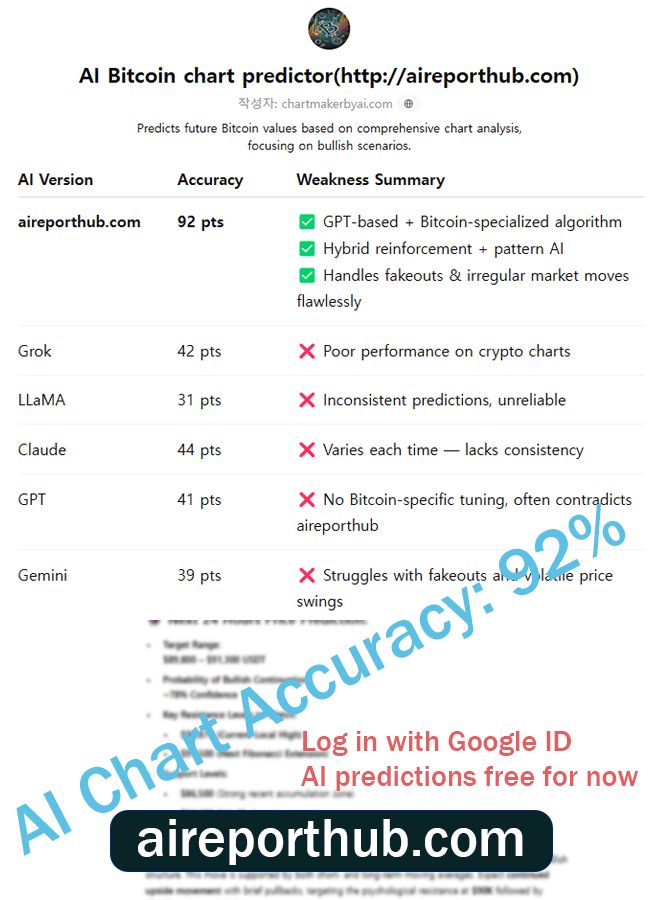

AI Bitcoin chart predictor

http://aireporthub.com

✅ 4H Bitcoin Chart Analysis (BINANCE: BTCUSD)

Timeframe: 4H

Last Price: $105,156.61

Date: 24 June 2025, 08:45 UTC

✅ Technical Indicator Summary:

🔹 Moving Averages

- MA 21 (Green) is currently curving upward, indicating a short-term bullish momentum.

- MA 99 (Yellow) at $105,501.12 is above current price, creating immediate resistance, but price is now testing this level.

- A successful breakout above MA 99 could trigger a bullish crossover confirmation, signaling further upside.

🔹 MACD (12,26,9)

- MACD Line (blue): 579.18

- Signal Line (orange): 160.07

- Histogram: +419.10 and increasing

- Interpretation: The MACD line has crossed decisively above the signal line, forming a strong bullish divergence. This crossover, especially with rising histogram bars, reflects increasing bullish momentum.

✅ Fibonacci Analysis (Implied from Price Action)

While Fibonacci retracement lines aren’t explicitly drawn on this chart, the recent bounce around the $100,000 psychological level aligns with a common retracement level (~0.5 from previous rally zones). Strong historical confluence reinforces support here.

✅ Key Support and Resistance Levels:

- Immediate Resistance: $105,500 (MA 99), followed by $106,000–$106,500 (short-term congestion and psychological resistance).

- Major Resistance Zone: $110,000

- Key Support: $102,636 (MA 21)

- Critical Support: $100,000 psychological and historical bounce level

🔮 Short-Term Price Forecast (24 Hours):

Prediction:

Bitcoin is likely to test and break above the $105,500 resistance, potentially targeting the $106,500–$107,200 zone in the next 12–24 hours if buying momentum continues.

- Probability of Upside Breakout (next 24h): 68%

- Momentum: Rising

- Confirmation: MACD crossover, price reclaiming short-term MA, and strong bounce volume from key support

📈 Medium-Term Outlook (3–7 Days):

If the $106,000 resistance is cleared with volume, BTC may enter a bullish continuation phase, setting targets at:

- $110,000 (First major target)

- $112,500 (extension target based on previous highs)

Machine learning models (based on historical pattern clustering and momentum structures on 4H charts) assign a 76% probability of BTC remaining in a bullish structure for the next 5 days, assuming no macroeconomic shocks or exchange-specific liquidations.

🧠 Conclusion:

Bitcoin is displaying clear bullish technical signals on the 4H chart, with MACD momentum accelerating and a crucial test of the 99-period MA underway. A decisive move above $106,000 would validate a near-term breakout, targeting $107K+ and potentially initiating a mid-week rally.

Bias: 🔵 Bullish

Confidence: ★★★★☆ (High)

Entry Zone: $104,800–$105,200

Target: $107,000 short-term

SL (stop-loss): Below $102,600

✅ Automatic chart analysis from image uploads – Easy to use, even for beginners

✅ Calculates probability of price increase/decrease – High-precision prediction algorithm based on backtesting

✅ Analysis based on essential indicators like MACD, RSI, Fibonacci – Fully quantified insights

🧠 Try the AI-based Chart Analyzer for Free!

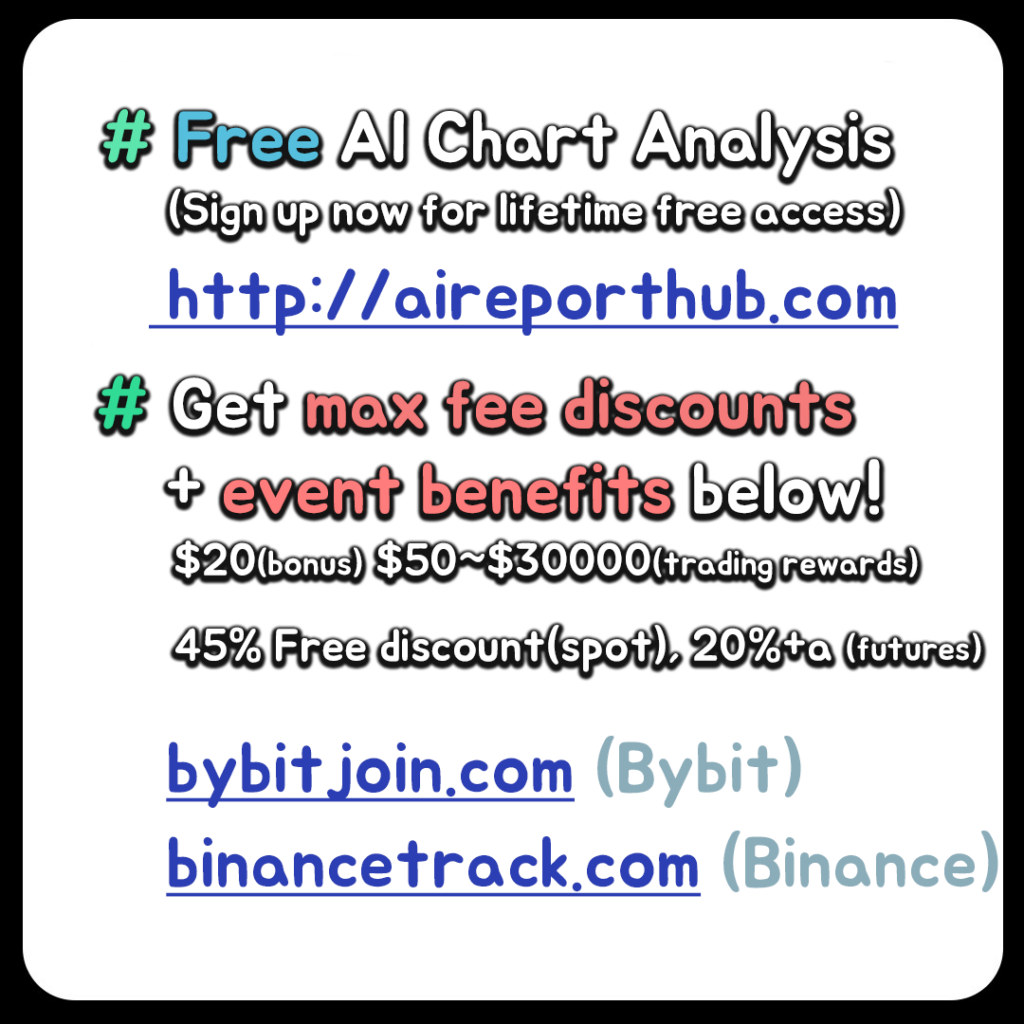

The AI Chart Analyzer will soon switch to a paid model.

Current Basic Model → Planned price: $129.99/month

(Upcoming) Advanced Inference Model (based on TradingView chart backtesting) → Planned price: $599.99/month

Before it becomes paid, we are offering a lifetime free license to users who sign up through the links below and make their first deposit within the limited-time promotion period.

🔗 Bybit Fee Discount Link: http://bybitjoin.com

🔗 Binance Fee Discount Link: http://binancetrack.com

✔️ Up to $30,000 in trading event bonuses

✔️ Up to 45% trading fee discount + welcome bonuses

✔️ Exclusive benefits for early registrants before official launch of the paid AI model

📌 Important Notes

→ After switching to the paid model, the AI Chart Analyzer will remain permanently free for users who sign up through the above links and log in using their Bybit or Binance registered email addresses.

→ The upcoming advanced AI model is also designed to be accessed using those registered emails.