As expected, it’s showing signs of moving toward the upper Bollinger Band, while also appearing to consolidate again.

This is a textbook example of a rally that typically follows after hitting the upper band. Lately, whipsaws have been rare—especially during periods of high trading volume, they’re almost nonexistent.

It’s starting to resemble a stock chart to the point that it feels nearly indistinguishable.

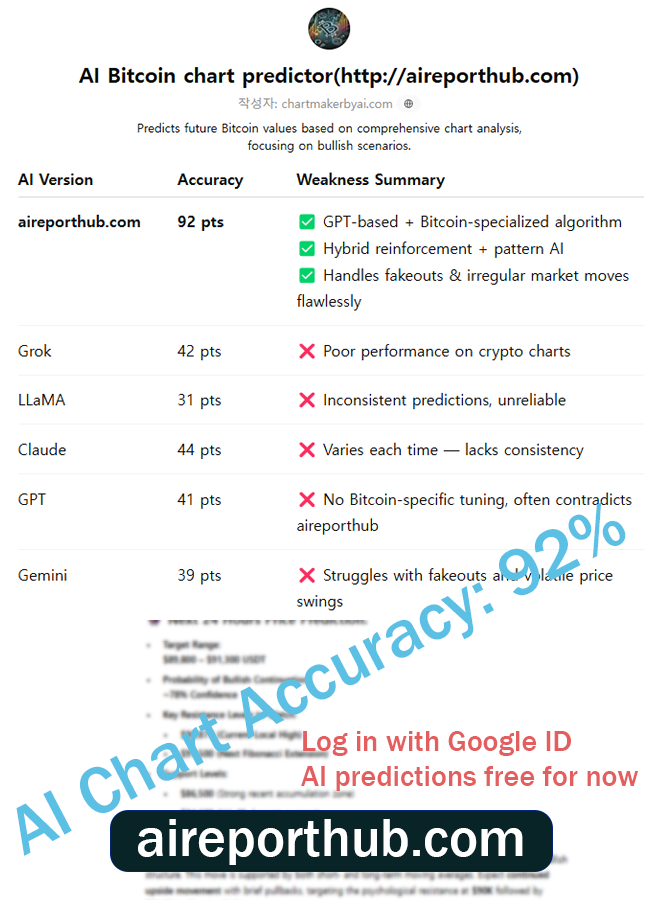

At this rate, it wouldn’t be surprising if AI eventually dominates every market.

The MACD line is barely holding steady, and short-term bearish signals continue to appear in the chart pattern.

While the price trend remains bullish in the mid-term, in the short term—specifically within the next 24 hours—it seems to have entered a phase of energy reaccumulation, or what traders often call a “pullback zone.”

This is a natural correction phase and a critical juncture that may determine whether we see a rebound or a further drop.

In such zones, some traders place bets in both directions, expecting a strong move either way—prepared to take a loss on one side while profiting on the other.

However, if the price gets swept up and down by a sudden whipsaw, it can result in the worst-case scenario. So such strategies are generally not recommended.

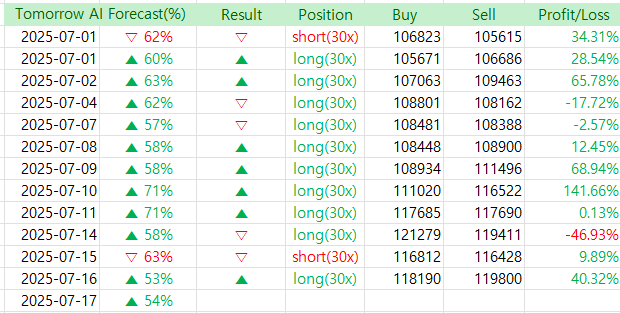

That said, AI prediction models currently show a 53% probability of an upward move within the next 24 hours. So I’m also leaning bullish for now.

Since we’re in a pullback zone, please proceed with extra caution. Thank you.