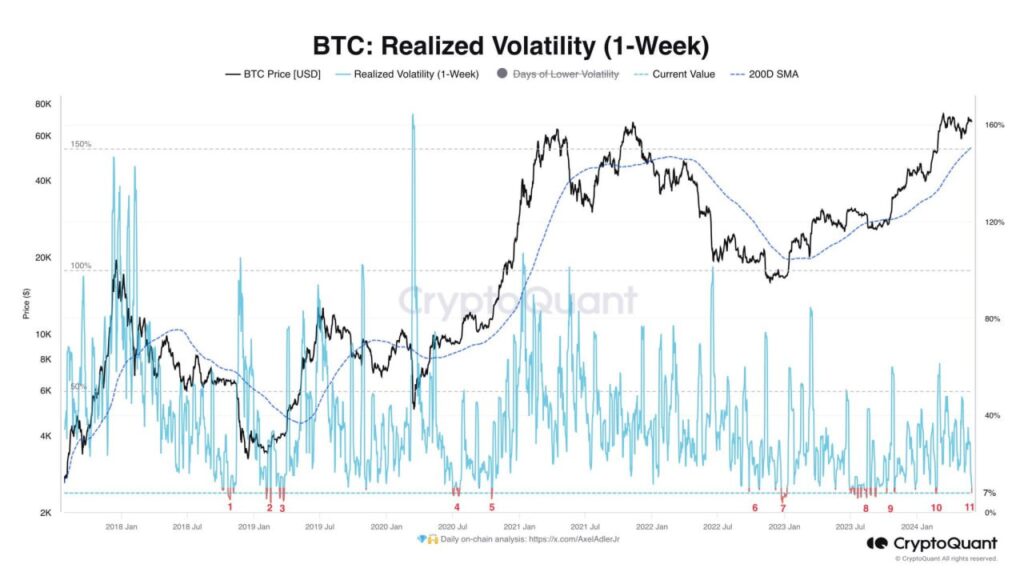

Bitcoin is currently stagnant at $67,500, with significant buying and selling volumes. Since it’s already June, the market may face short-term downward pressure and begin to decline, but there is a longer-term bullish sentiment. Unlike previous months, a large volume of Bitcoin was bought rather than sold in May.

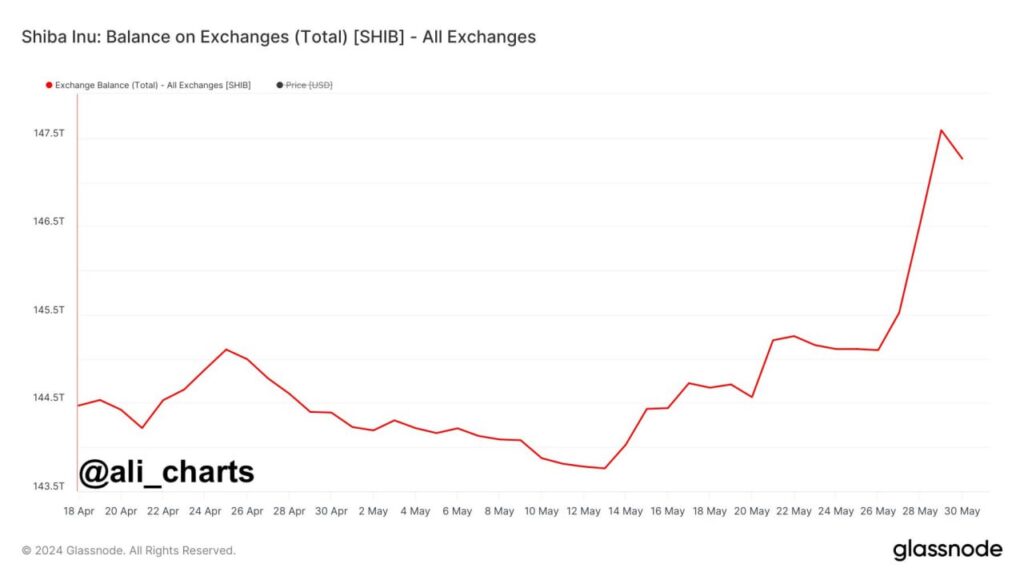

The charts for altcoins are also very promising. Typically, altcoins surge explosively when their moving averages on daily, weekly, and monthly charts converge during Bitcoin’s major bullish phases. It’s hard to predict when this will occur, but it feels imminent, like a dormant volcano about to erupt again.

After the ETF listing, Bitcoin’s movements have slowed, and it takes longer to establish a direction after each movement. The influence of one major exchange has diminished, and now the ETFs seem to limit Bitcoin’s movements considerably.

The direction Bitcoin will take this June is highly anticipated. Personally, I expect a significant drop in the first or second week of June to shape the chart before a sharp rise, which could enable many traders to profit.

I usually don’t predict long-term movements because Bitcoin’s price can skyrocket or plummet suddenly, often showing dramatic changes within 24 hours.

However, this time, I am hopeful and will venture a prediction. I expect a decline in the next 24 hours and a significant rise throughout June.

Bitcoin may be uneventful now, but if things unfold as predicted, I firmly believe a bullish market will form through altcoins.