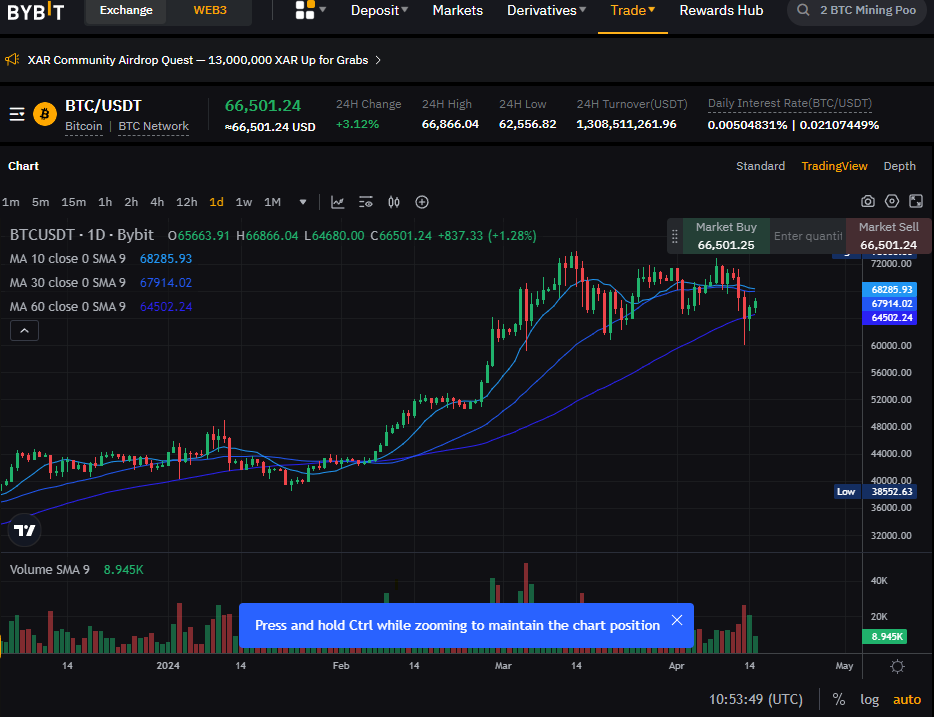

Bitcoin recently experienced a sharp drop followed by a partial recovery due to escalating tensions between Israel and Iran. However, this movement should not be overly emphasized. It appears that Bitcoin’s price tends to rise or fall based on how any news is perceived as either bullish or bearish. Essentially, the decline was due, and the tensions were merely a trigger.

Had Bitcoin continued to rise into the $70,000 range, those holding long positions would have realized substantial profits. Therefore, a drop of at least 10% to liquidate some positions before rising again seems like a natural course of action.

I am still optimistic about Bitcoin’s potential for a price increase, but it is crucial to remain objective. Watching the weekly candlestick chart is key at this moment. Setting a stop-loss and being prepared to cut losses if the price reaches this level is a necessary strategy.

If the weekly chart breaks down, this isn’t just a temporary dip before a rise; it signals a real downturn.

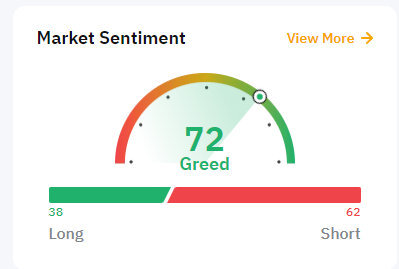

The next few days will be critical. Paying close attention to the weekly chart and monitoring shifts in investor sentiment will be crucial.